Last updated on December 9th, 2024 at 10:29 am

Do you desire to know the 7 best real world assets for wealth management?

Then, read through this article to get firsthand knowledge about it.

What are real-world assets?

Real World Assets (RWA) in crypto refers to the tokenization of tangible assets that exist in the physical world that are brought on chain. They also include the growing issuance of capital market products on-chain, where digital securities are tokenized and offered to retail customers.

While tokenization is the process of creating digital tokens using blockchain and smart contracts to represent ownership or rights, These tokens can be issued, traded, and managed on the blockchain. For instance, company shares, physical goods, or commodities are typical examples of financial assets that can be tokenized. Check out this article to learn more about tokenization.

How Tokenized Real World Assets Work (RWA)?

Real-world assets are assets that have a physical existence but are tokenized and transitioned online for utilization within the space. It’s important to select the right assets, such as:

- Real Estate

- Automobiles

- Precious metals, e.g. gold, diamonds, etc.

- Government bonds

- Enterprises and

- many more tangible and intangible assets.

The assets need to be transposed or tokenized from the tangible realm to the blockchain network. These processes can be categorized into three steps:

Step 1: Identification

Real-world assets must first be identified offline before they can be incorporated into DeFi to understand the assets, their price, ownership, and documentation.

Step 2: Integration into The Network/Tokenization

The information collected will be inscribed into the blockchain, supplemented by legally mandated data and the deployment of oracles to mirror the true value of the assets.

Step 3: RWA Management Protocol

It’s important to establish a protocol to oversee all the processes. RWA are in existence in the real estate space, though there popularity and demand are currently underwhelming. While the domain of private lending built within DeFi is gaining traction.

Difference Between DeFi And TradFi

Decentralized Finance (DeFi) and Traditional Finance (TradFi) represent two vastly different approaches to managing and facilitating financial transactions. While both systems aim to enable financial interactions, their underlying structures, operations, and philosophies diverge significantly.

Transactions carried out at Real World Assets are characterized by the involvement of third parties to provide security and stability.

Top Real World Assets Protocol

The RWA assets represented are valuable and recognized globally; this shows the value and rights of these assets are widely accepted and understood, making them viable for transactions, investments, and other financial operations globally. We’ll be considering some of the top real-world assets:

1. Synthetix

It’s a derivative liquidity protocol that creates synthetic assets by offering unique decentralized derivatives for physical assets on blockchain. Investors can explore the Synthetix debt pool for best price execution, strong liquidity, and little slippage.

2. Centrifuge

Centrifuge is a groundbreaking platform designed to connect real-world assets (RWA) with the decentralized finance (DeFi) ecosystem, creating new avenues for liquidity and innovation in financial markets. By tokenizing tangible assets like invoices, real estate, or inventory, Centrifuge enables individuals and businesses to access DeFi funding without relying on traditional financial intermediaries like banks or brokers.

3. MakerDAO

MakerDAO is one of the most established and influential decentralized finance (DeFi) protocols operating on the Ethereum blockchain. It enables borrowing and lending in a fully decentralized manner while maintaining stability in the crypto market through its native stablecoin, DAI. Unlike traditional financial systems, MakerDAO operates without intermediaries, relying instead on smart contracts and a decentralized governance model.

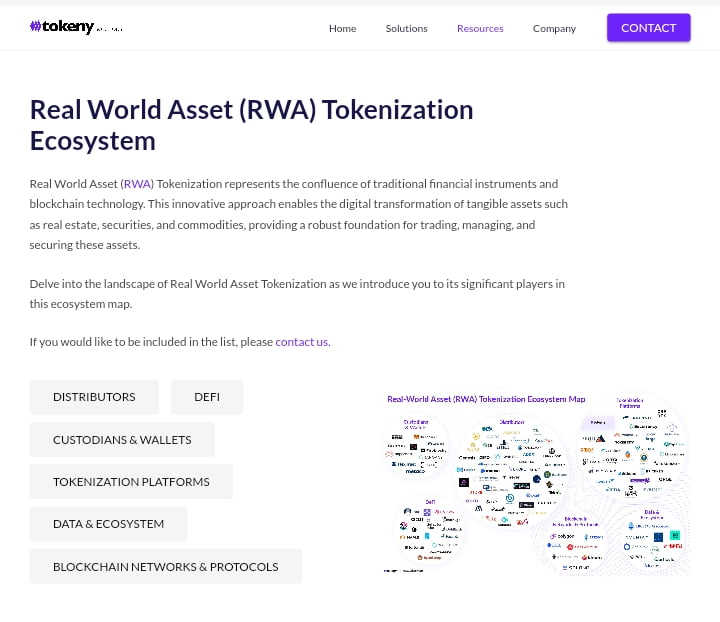

4. Tokeny

Tokeny is an institutional-grade platform that controls companies operating in private markets to benefit from blockchain technology to improve efficiency, automation, and competitive advantage. This modular end-to-end platform issues, transfers, and manages tradable digital assets.

5. Polytrade Finance

Polytrade Finance is a top lending protocol on 0xPolygon that connects sustainable real-world asset yields to DeFi. It’s aims to revolutionize trade finance with its core products to connect real-world finance to Web3 through cutting-edge DeFi and fintech.

6. Credix

Credix is an innovative decentralized finance (DeFi) platform designed to revolutionize access to liquidity. It bridges the gap between institutional investors and borrowers, providing a streamlined and efficient mechanism for financing that delivers attractive, risk-adjusted investment opportunities. The ecosystem caters to a range of participants, including institutional investors, credit funds, and accredited investors, making it a versatile platform for large-scale financial interactions.

7. Ondo Finance

Ondo Finance is a top DeFi platform that offers risk-isolated, fixed-yield loans backed by yield-generating crypto assets to facilitate diverse investments. With Ondo Finance, investors can invest in US treasuries through Ondo’s OUSG funds using a crypto wallet.

Challenges of Tokenization

This innovative technology implementation demands legal adoption and, consequently, regulatory innovation for its financial instrument. Regulatory challenges have emerged as a trend in 2023 to signify there exists no unified approach to the adoption and regulation of cryptocurrency worldwide: we witness the measures of the SEC, which doesn’t incline to adapt the outdated legislation, juxtaposed with the actions of the Hong Kong regulator, which provides a different control system, more congenial to the Web3 world.

- The governance of real-world assets could prove intricate due to differences in legislative constructs across nations. jurisdiction of diverse regulators would influence assets, thereby rendering the tokenization process and regulatory compliance convoluted. However, it must be acknowledged that regulation and oversight are inalienable prerogatives of sovereign states and subsidiary institutions that none would voluntarily relinquish

- Difficulties arise not solely within the legal sphere but also in the confluence of the cryptocurrency realm with the tangible world, particularly concerning the mechanisms of enforcement and liquidation of positions collateralized by real world assets. The procedure isn’t as swift as the liquidation of cryptocurrency assets and necessitates the institution of suitable procedures and mechanisms.

- Tokenizing RWA necessitates precise asset appraisal and validation. This could be a protracted and expensive process, especially for specific asset types such as real estate or debt instruments.

- The integration of RWAs into the blockchain milieu requires the development of technically advanced solutions to connect traditional assets to digital tokens. This could pose a barrier to the widespread adoption of real-world asset tokenization.

- Despite the fact that the DeFi sector has been evolving for several years, its comprehension and technologies remain subpar. Many market participants, including investors and businesses, are not adequately aware of the opportunities and benefits proffered by tokenizing real-world assets. Propagating knowledge about DeFi and attracting fresh participants to the market necessitate substantial educational and awareness efforts.

Conclusion

FAQ

What are raw real-world assets?

Real-world assets (RWAs) are physical or financial assets that exist in the real world, like cash, commodities, real estate, equities, and bonds.

How does the RWA token work?

RWA tokens are stored on the blockchain or other distributed ledger, which guarantees immutability and protection against unauthorized access

![Read more about the article 7 Best Ways To Generate Passive Income With Crypto [2025]](https://cryptopuncher.com/wp-content/uploads/2024/05/Farming-Airdrops-On-Solana-300x158.png)