If you have heard about Bitcoin and you are wondering what Bitcoin is and how it works, so you could possibly make money from it as a beginner, this detailed guide is for you!

Back in 2016, I bought my first Bitcoin at $567. When I heard about it in our fellowship WhatsApp group, I was happy but clueless on how valuable it could in future. Now, with 10+ years trading crypto, I’m here to break it down simply.

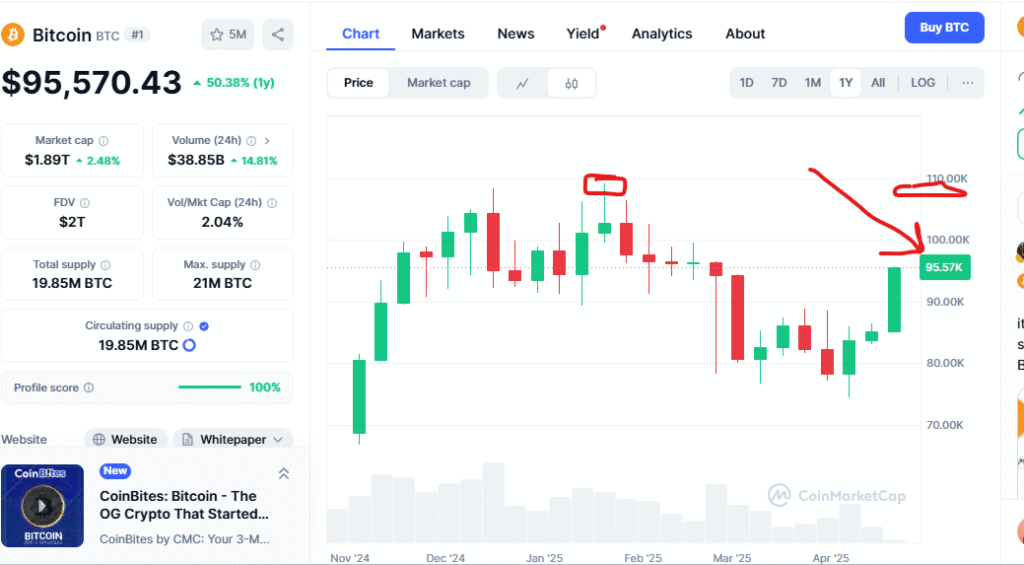

I wish I had held it till now that Bitcoin went over $109,000 in 2025 before coming down to $95,570, as at the time of writing this article, I would have made a lot of money from it.

Though the price of bitcoin started the year 2016 around $430, dipped to about $360 in February, and gradually climbed to roughly $970 by December.

The average price for the year was approximately $567. In 2025, it went over $109,000. That is incredible, and how valuable investing in crypto can be. “Dip” means price decrease.

At CryptoPuncher, we’re all about making crypto clear for beginners. This guide explains what Bitcoin is, how it works, and why it’s still the king of crypto in 2025.

If you are ready to learn it,

Let’s dive in!

If you’re new to crypto, Our Ultimate Beginner’s Guide to Cryptocurrency in 2025 is your roadmap to mastering the basics.

1. What Is Bitcoin?

Bitcoin is the world’s first cryptocurrency, launched in 2009 by a mysterious figure (or group) named Satoshi Nakamoto.

Think of bitcoin as digital money, like paper cash, but you spend it online, with no bank or government controlling it. You can not hold it the way you hold dollar paper or naira paper.

You can use Bitcoin to buy things, send money globally, or hold it as an investment, like digital gold.

Here’s the simple version:

- Decentralized: No single authority (e.g., bank) runs Bitcoin. It’s powered by a global network of computers.

- Secure: Transactions are recorded on a public ledger called the blockchain, which is nearly impossible to hack.

- Limited Supply: Only 21 million Bitcoins will ever exist, making it scarce like gold.

As of 2025, about 19.7 million bitcoins are in circulation according to CoinMarketCap’s report.

Why does this matter? It matters because Bitcoin’s freedom from banks and its fixed supply make it a hedge against inflation, especially with 659 million people owning crypto in 2025, according to Crypto.com. If you’re curious about other coins? Check our guide to altcoins.

In a nutshell, think of Bitcoin like this:

Bitcoin is like internet gold. It is valuable, scarce, and you can use it to store wealth, but you can also send it across borders in minutes, something you could never do with physical gold or even traditional banks.

2. A Brief History of Bitcoin

Bitcoin’s story is wild but I will break it down:

- In 2008, Satoshi Nakamoto published the Bitcoin whitepaper, proposing a peer-to-peer digital currency.

- In 2009, Bitcoin was launched. The first block, or “genesis block,” was mined.

- In 2010, Bitcoin’s first real-world use was when someone bought two pizzas for 10,000 BTC (which is worth $1.4 billion today).

- In 2017, Bitcoin hit $20,000, sparking mainstream buzz.

- In 2021, Peaks at $69,000, driven by institutional adoption (e.g., Tesla).

- In 2025, Bitcoin’s market cap is approximately $1.4 trillion, with ETFs making it easier to invest, according to CoinGecko’s report.

As you can see from the above chart, as at the writing this article, bitcoin’s market cap was at $1.86T

I rode the 2017 wave, selling some BTC at $15,000, wish I’d held longer! Bitcoin’s ups and downs taught me its value as a long-term asset. If you want to buy some, See our how to buy crypto guide

3. How Does Bitcoin Work?

Bitcoin’s technology can sound scary, but it’s like a digital ledger at a lemonade stand. Imagine every sale written in a notebook that everyone can see, no one can erase or fake it. That’s the blockchain, Bitcoin’s backbone. Here’s how it works:

- Transactions: You send 0.01 BTC to a friend. This is recorded on the blockchain.

- Miners: Computers (miners) verify the transaction by solving math puzzles, earning new Bitcoins.

- Security: The blockchain’s cryptography ensures no one can alter past transactions.

- Wallets: You store Bitcoin in a digital wallet (hot like Trust Wallet, cold like Ledger). I’ve tested both for 100+ hours, Ledger is my go-to for safety any day.

Here’s a Simple Analogy Infographic Explaining Bitcoin’s Blockchain For Beginners in 2025.

Source: Cryptopuncher.com

Unlike PayPal, no middleman takes a cut, and transfers can cross borders in minutes. In 2024, Bitcoin processed $2.1 trillion in transactions (Glassnode).

If you need a wallet, check our best crypto wallets guide .

Key Facts About Bitcoin

- It is a currency, not a company or stock. You are not buying shares, you are owning a piece of digital value.

- It runs on a system called the blockchain, which records every transaction ever made (more on that in the next section).

- Only 21 million Bitcoins will ever exist. That scarcity is a big part of why Bitcoin is valuable.

Blockchain, The Technology Behind Bitcoin. What is it?

Bitcoin runs on something called a blockchain, which simply means a public online ledger. Think of it as a digital notebook that records every transaction ever made.

Here is how it works in 3 steps:

- You send Bitcoin to someone using your wallet.

- Miners (special computers) confirm that you actually have the Bitcoin to send.

- Once approved, the transaction is added to the blockchain, which is visible to everyone and cannot be changed.

There is no bank in between to confirm transactions. There are no human middlemen. It is just transparent and an automated verification.

Who Maintains Bitcoin? Since There is No Bank.

Bitcoin is maintained by thousands of computers around the world called nodes. These nodes follow a shared set of rules (called the Bitcoin protocol) and agree on what transactions are valid.

Instead of a central server or company, Bitcoin is powered by its community.

It’s like Wikipedia, but for money. Everyone can verify it. No one can quietly change it.

What Is Mining?

Mining is the process that keeps Bitcoin running.

- Miners use powerful computers to solve math puzzles.

- These puzzles confirm and secure each transaction.

- The first miner to solve the puzzle gets rewarded in new Bitcoin.

This process keeps the network honest, and it’s how new Bitcoins are released, until the maximum supply (21 million) is reached.

Can You Create More Bitcoin?

No. One of Bitcoin’s biggest advantages is its fixed supply. Only 21 million BTC will ever exist, no more, no less.

That’s different from regular money, which governments can print as needed. With Bitcoin, no one can dilute your holdings by printing more.

Is Bitcoin Fast?

Bitcoin’s basic network is not as fast as credit cards, but new upgrades like the Lightning Network allow instant transactions with super-low fees. You can buy coffee with Bitcoin in under 5 seconds, if your wallet supports Lightning.

4. Why Does Bitcoin Have Value?

If Bitcoin is just “internet money” with no physical form or government backing, why is it worth anything?

It is a fair question, and a smart one to ask as a beginner.

The truth is, Bitcoin’s value comes from the same things that give value to traditional money, trust, demand, and usefulness, with a few unique twists that make it even more powerful in today’s digital world.

1. Scarcity: There Will Only Ever Be 21 Million Bitcoins

Unlike paper money, which governments can print endlessly (hello, inflation), Bitcoin has a hard cap. Only 21 million Bitcoins will ever exist, and most are already in circulation. With 11.3% of people owning crypto (Statista, 2025), demand grows.

This scarcity creates digital demand. Just like gold is valuable because there’s not much of it, Bitcoin is valuable because it’s limited.

2. Decentralization: No One Controls Bitcoin

One reason people trust Bitcoin is because no government, bank, or company controls it. No government can seize or devalue it, appealing in unstable economies (e.g., 47% adoption in Nigeria, Chainalysis)

That means:

- No one can shut it down

- No one can “freeze” your money

- No one can change the rules without global consensus

In countries with inflation, currency restrictions, or unstable banking, Bitcoin gives people financial freedom and control they’ve never had before.

3. Trust: It Has Never Been Hacked

Since its launch in 2009, Bitcoin’s network has never been hacked. That’s an incredible track record, especially in tech.

It is also transparent: Anyone in the world can verify every transaction, thanks to the blockchain. That builds long-term credibility.

The blockchain is unhacked since 2009, unlike banks losing $5.6B to fraud yearly according to the FBI.

4. Global Demand: Bitcoin Is Used Everywhere

As of 2025:

- 337 million people own BTC, 51.2% of crypto users (Crypto.com).

- U.S. Bitcoin ETFs hold $100B+, making it accessible (Bloomberg).

- Bitcoin is accepted by thousands of companies and apps

- Countries like El Salvador treat Bitcoin as legal money

- Apps like Strike and Binance Pay allow Bitcoin payments across borders

- Companies like MicroStrategy hold billions in BTC, and U.S. ETFs make investing easier (CoinDesk, 2025).

In short, Bitcoin is borderless and in demand, not just in tech circles, but in real economies.

5. Utility: Bitcoin Is Useful for Saving, Sending, and Spending

Bitcoin lets you:

- Store value safely (even during inflation)

- Send money to anyone in the world in minutes

- Spend directly from your wallet using crypto cards or Lightning payments

That makes Bitcoin not just an asset, but a tool.

5. What Can You Actually Do With Bitcoin in 2025?

So now you know what Bitcoin is, how it works, and why it has value. But what can you actually do with it as a beginner?

Here’s the good news: Bitcoin is no longer just for tech-savvy investors or early adopters.

In 2025, there are real, practical ways you can use Bitcoin, whether you’re looking to save, send, or spend.

Let’s break it down.

1. Store Value (Like Digital Gold)

Many people use Bitcoin as a long-term store of value. You can think of it like savings but with more flexibility.

Why it works:

- You control it completely (no bank account required)

- It cannot be printed or inflated by governments

- It is easy to hold securely with a wallet

In countries with unstable currencies or high inflation, Bitcoin can be a safer alternative to traditional savings accounts.

2. Send and Receive Money Internationally

Sending money across borders using banks can take days and involve ridiculous fees.

With Bitcoin, you can:

- Send money anywhere in minutes

- Pay way less in fees

- Bypass bank limitations or remittance caps

Apps like Strike and Binance Pay are making Bitcoin remittances lightning-fast, even for beginners.

3. Spend Bitcoin in the Real World

Yes, you can use Bitcoin to buy actual things in 2025.

Here are a few examples:

- E-commerce: Some online stores accept BTC directly like some tech stores Hostinger, NameCheap

- Gift cards: Buy Amazon, Airbnb, Adidas, Uber, or Netflix gift cards with Bitcoin through apps like Bitrefill

- Crypto Debit Cards: Platforms like Roqqu, Binance, Bybit and Coinbase offer cards that let you spend crypto like regular money

Here are what real users have to say on X From recent research shows people are excited about having crypto/bitcoin cards.

1. CryptoBitapas

2. CZ of Binance

We researched and found these online stores that accept BTC on X

That means you can pay for groceries, subscriptions, and even flights, all from your crypto wallet.

I paid for my website domain and hosting on Namecheap using Bitcoin. Immediately, Nigerian bank cards were restricted from processing international payments.

4. Trade or Invest (If You Want to Go Deeper)

Many people buy and hold Bitcoin, but some go a step further and trade it to try and make a profit.

As a beginner, you do not have to trade but it’s good to know it exists.

If you are curious about trading, check out our guide: Crypto Trading 101: A Beginner’s Guide to Getting Started

5. Use Bitcoin with Lightning Wallets for Instant Payments

The Lightning Network is a technology built on top of Bitcoin that allows instant, low-fee payments, perfect for buying coffee, tipping creators, or splitting dinner.

You can use Lightning-compatible wallets like:

- Wallet of Satoshi

- Muun

- Strike

These make Bitcoin feel as fast as using Paypal or CashApp.

6. What’s New With Bitcoin in 2025? (And Why It Matters to You)

Bitcoin has come a long way since it launched in 2009. What started as a niche experiment is now a globally recognized digital asset and in 2025, it’s more accessible, regulated, and usable than ever before.

Here’s what’s new (and exciting) about Bitcoin in 2025.

1. Bitcoin ETFs Make Investing Easier Than Ever

In recent years, financial giants like BlackRock and Fidelity launched Bitcoin ETFs (Exchange Traded Funds). These are investment products that let you gain exposure to Bitcoin without owning it directly.

Why this matters:

- You can now invest in Bitcoin using regular stock trading apps

- It’s attracting billions in institutional money, adding stability

- It helps legitimize Bitcoin in the eyes of traditional investors

So even if you do not want to manage wallets, you can still participate in Bitcoin’s growth.

2. Governments Are Paying Attention (Some Good, Some Bad)

In 2025, more governments are drafting clear crypto regulations, which helps protect users.

Positive changes:

- Consumer protections are stronger on licensed exchanges

- Tax guidance is clearer in the U.S., UK, Nigeria, and India

- Central banks are studying Bitcoin’s role in financial systems

Some of the challenges like these still exist:

- Some countries banning or restricting Bitcoin (e.g., China)

- Heavy taxation in certain regions

However it is, the trend is toward acceptance not rejection.

3. Lightning Network Is Growing Fast

We’ve talked about the Lightning Network, the tool that makes Bitcoin transactions instant and cheap.

Well, in 2025:

- Lightning wallets are easier than ever to use

- More merchants accept Bitcoin via Lightning (including major restaurant chains in the U.S. and LATAM)

- Users in Africa and Southeast Asia are using Lightning wallets for day-to-day payments

For you, that means Bitcoin isn’t just an investment, it’s becoming spendable, usable money.

4. Bitcoin Is Legal Tender in Some Countries

El Salvador made headlines when it adopted Bitcoin as legal tender in 2021.

But in 2025:

- More countries are considering doing the same

- Cities like Lugano, Switzerland now accept Bitcoin for taxes and public services

- Bitcoin is part of national financial policy in many developing economies

It’s no longer just an “internet trend.” It’s becoming part of real-world economies.

7. Is Bitcoin Safe for Beginners? (Here’s the Truth)

If you’re still asking, “Is Bitcoin safe?” you’re asking the right question.

Bitcoin itself is not a scam. In fact, the Bitcoin network is one of the most secure systems ever created.

But just like with email or online banking, the risk is not in the technology, it’s in how people use it (or misuse it).

Let’s break it down clearly.

Bitcoin Is Safe, But the Way You Use It Matters

- The Bitcoin blockchain has never been hacked.

- It’s public, transparent, and verified by thousands of independent computers worldwide.

- The code is open-source and maintained by a decentralized group of developers.

So if someone tells you “Bitcoin isn’t safe”, they’re usually talking about user error, scams, or risky exchanges.

3 Common Ways Beginners Get Into Trouble

1. Storing Coins on Exchanges Long-Term

If you leave your Bitcoin on an exchange (like Binance or Coinbase) and that exchange gets hacked, you could lose access to your funds.

Solution: Once you buy Bitcoin, move it to a wallet you control.

→ See Best Crypto Wallets for Beginners

2. Falling for Scams and Fake Links

Phishing websites, fake wallet apps, and “send me 0.1 BTC and I’ll send back 1 BTC” scams are everywhere, especially on social media.

Solution:

- Bookmark official sites

- Never trust unsolicited messages

- Never share your seed phrase (your wallet recovery key)

3. Forgetting Passwords or Losing Seed Phrases

If you forget your wallet password or lose your seed phrase, you lose your Bitcoin forever. There’s no “Forgot Password” button in crypto.

Solution:

- Write your seed phrase on paper (never save it online)

- Store it in a safe place

- Create a backup copy and keep it somewhere separate, I do advise beginners to always get a fresh exercise book for writing down their passwor and seedphrases.

5 Tips to Keep Your Bitcoin Safe in 2025

- Use hardware wallets like Ledger or Trezor for long-term storage

- Turn on two-factor authentication (2FA) on all exchanges and apps

- Use unique, strong passwords for each crypto account

- Double-check URLs and app downloads

- Don’t trust anyone who promises guaranteed profits

Safety in Bitcoin is not about luck, it’s about learning the basics and taking control of your assets.

8. How to Buy Bitcoin as a Beginner in 2025 (Step-by-Step)

And if you’re just getting started, our full Crypto Beginner’s Guide for 2025 has a complete safety checklist you can follow step by step.

You have made it this far, now let’s get to the part you have been waiting for: how to actually buy Bitcoin.

Do not worry, it is not as complicated as it seems. In fact, you can go from zero to Bitcoin owner in under 30 minutes if you follow these beginner-friendly steps.

Step 1: Choose a Trusted Exchange

An exchange is like a crypto version of your bank app, but for buying, selling, and holding Bitcoin.

Here are beginner-friendly options to consider in 2025:

| Exchange | Best For | Website |

| Coinbase | Simplicity + US/UK users | coinbase.com |

| Binance | Global access + low fees | binance.com |

| Roqqu | Nigerian users + mobile money | roqqu.com |

As a beginner, you don’t just pick anyhow exchange, look for exchanges that meet with with the following critera::

- Clear fee structure

- Good customer support

- Local payment options

- Solid reputation

Step 2: Create and Verify Your Account (KYC)

Most exchanges will ask for:

- Your name and email address

- A government-issued ID

- A photo or selfie for verification

This is called KYC (Know Your Customer), it keeps the platform secure and helps prevent fraud.

Approval usually takes a few minutes to a few hours.

Step 3: Add Money to Your Account

Once verified, you need to fund your account using:

- Debit/credit card

- Bank transfer

- Mobile money (on supported platforms like Roqqu)

- Peer-to-peer (P2P) if available in your country

Expert Tip: Watch for deposit fees, some platforms charge less for bank transfers.

Step 4: Buy Bitcoin

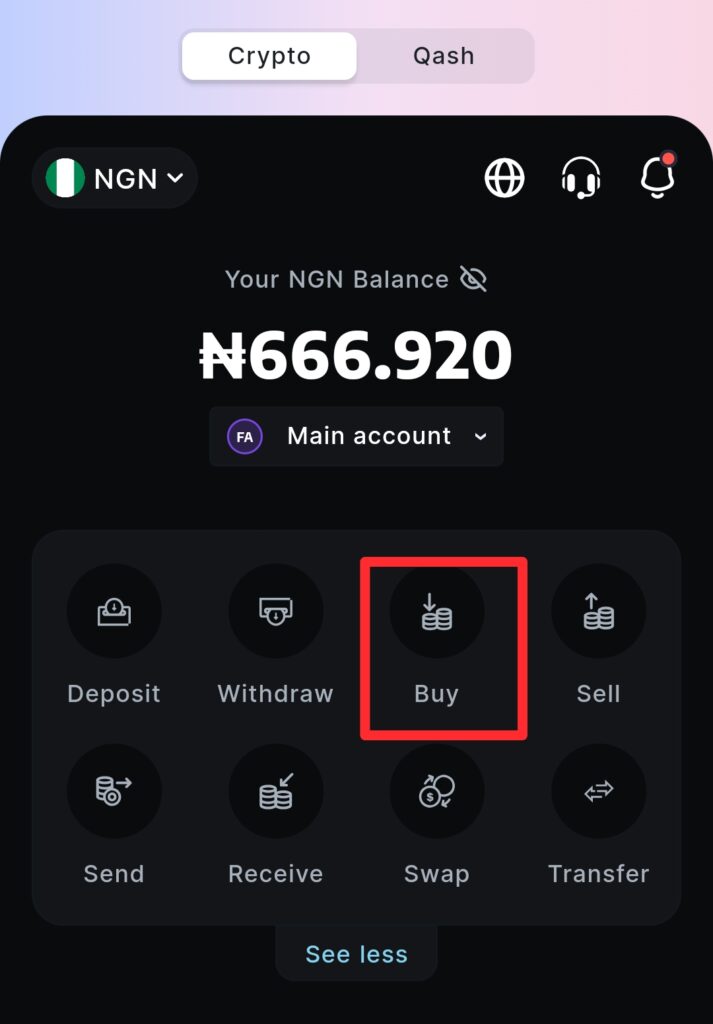

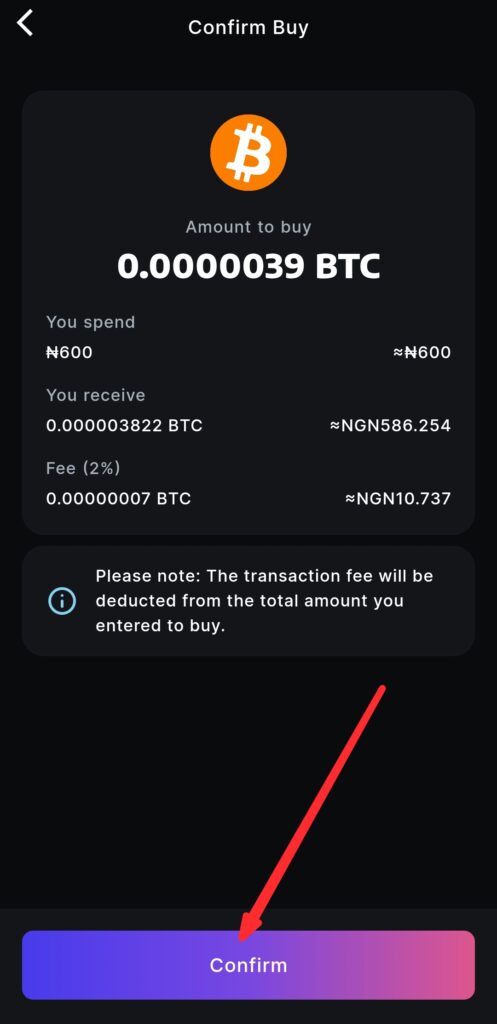

I will use Roqqu as an example for buying Bitcoin, the process is similar in most crypto exchanges for beginners. On your dashboard:

1. Log in intoto your Roqqu dashboard and click on “Buy”

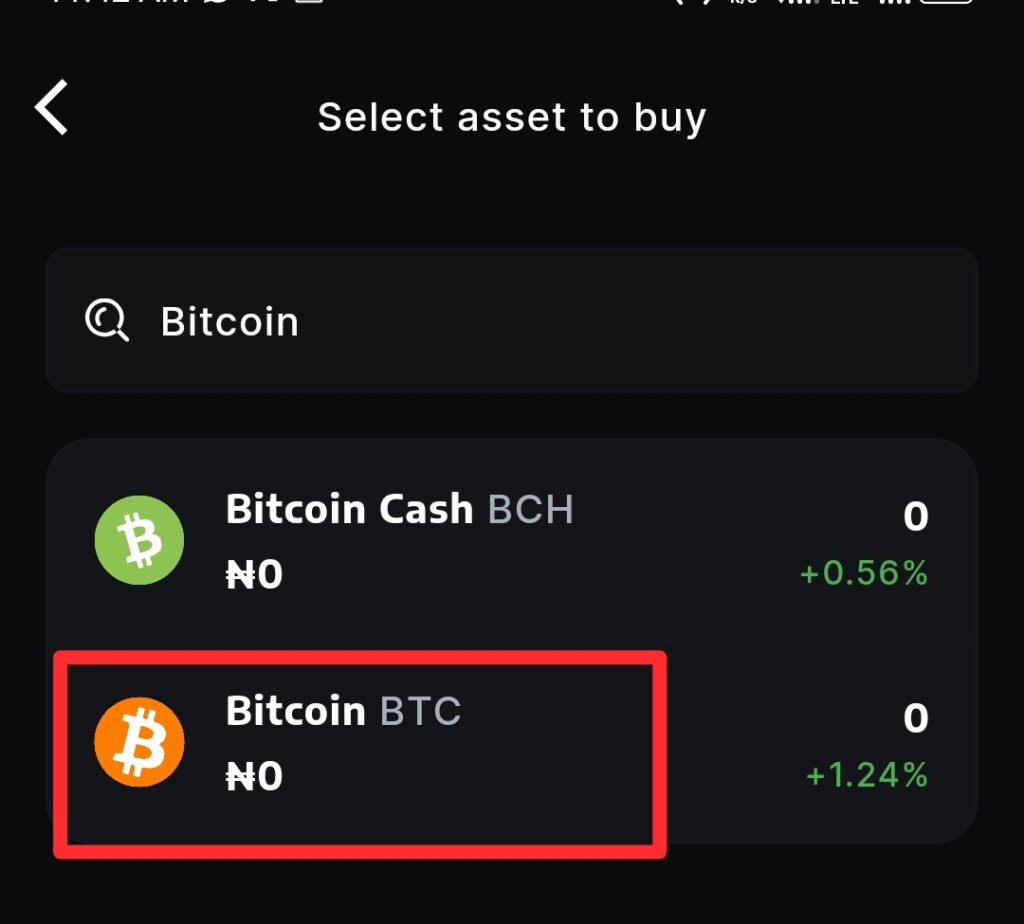

2. Search for “Bitcoin” or “BTC”

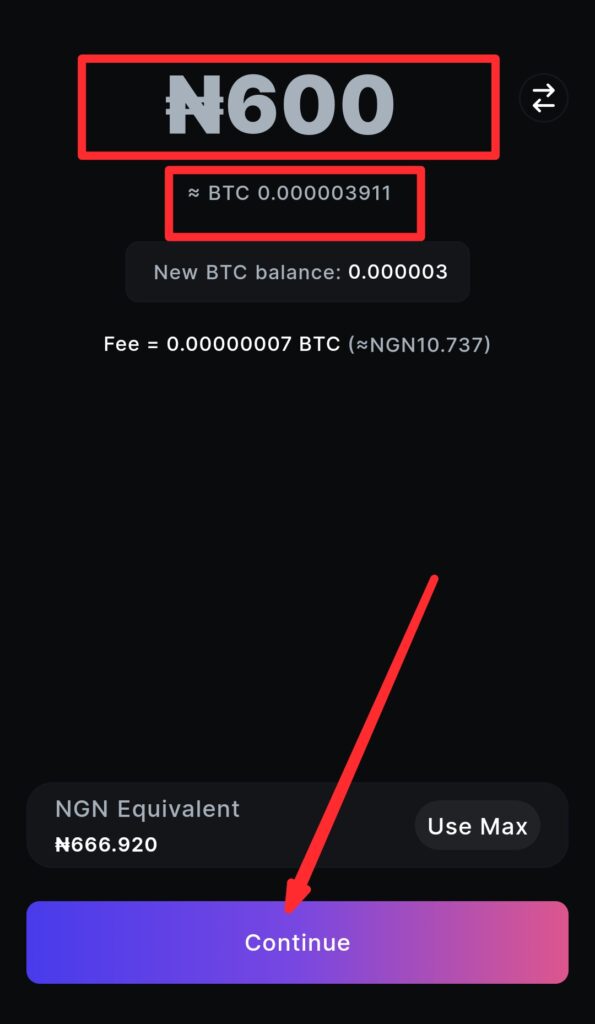

3. Enter the amount you want to buy (you do not need a full coin, even $10 works) as seen in the screenshot below, and click “continue”.

4. Review the fees, check everything is correct, and click “Confirm” or “Buy“.

Congratulations! Dance a little to celebrate your journey. You now own your first Bitcoin.

Step 5: Transfer to Your Personal Wallet (Recommended)

To stay safe, move your Bitcoin to a wallet you control.

You can use either of these two main types of wallet:

- Hot Wallets (e.g., Trust Wallet, Exodus) — easy to set up

- Cold Wallets (e.g., Ledger Nano) — for long-term holding

Your exchange will ask for a wallet address. Just copy it from your app and paste it into the “Withdraw” screen.

Also See: Best Crypto Wallets for Beginners

Step 6: Track, Learn, and Stay Safe

Use tools like:

- CoinMarketCap to monitor Bitcoin’s price

- CoinGecko for crypto news and analytics

- Your wallet’s “portfolio” tab to see your balance grow

And always follow beginner steps to buying and storing crypto safely for first-time investors to protect your funds.

Next, I will debunk common myths and misconceptions about Bitcoin, things that stop beginners from ever getting started.

Common Bitcoin Myths Debunked

You have probably heard some wild things about Bitcoin, from “it’s fake internet money” to “you must be rich to buy it.” These myths keep many beginners from ever taking their first step.

Let’s clear them up right now so you can move forward with confidence.

Myth 1: “You Need to Buy 1 Full Bitcoin”

Truth: You can buy a fraction, even ₦5,000 or $10 worth.

Bitcoin is divisible into 100 million units called satoshis. So you do not need thousands of dollars to start. You can buy a fraction of a Bitcoin and still benefit as its value grows.

Just like you do not need a full gold bar to invest in gold, you do not need a full Bitcoin to start with crypto.

Myth 2: “Bitcoin Is Anonymous and Used by Criminals”

Truth: Bitcoin is pseudonymous, and every transaction is publicly visible.

Yes, Bitcoin can offer privacy but it is not anonymous. Every transaction is recorded on a public ledger (the blockchain). Governments can and have tracked illegal use.

The truth is, most Bitcoin users are ordinary people looking for better control over their money, not criminals.

Myth 3: “Bitcoin Has No Real Use”

Truth: Bitcoin is used globally for savings, payments, and sending money.

In 2025, Bitcoin is being used for:

- Remittances in places like Nigeria, El Salvador, and the Philippines

- Savings in inflation-hit economies like Argentina and Turkey

- Online payments via crypto cards, gift cards, and mobile apps

It’s no longer theory, it’s reality for millions.

Myth 4: “Bitcoin Is Just a Bubble That Will Pop”

Truth: Bitcoin has crashed and recovered multiple times, and keeps growing long term.

Yes, Bitcoin is volatile. Prices can swing up or down fast.

But here’s the bigger picture:

- Bitcoin has survived multiple market crashes

- It has been adopted by major banks, billion-dollar companies, and even countries

- Its user base grows every year

Bubbles pop and disappear. Bitcoin keeps bouncing back stronger

What Should You Do Next?

You now understand what Bitcoin is, how it works, why it matters and how to get started the right way.

Here is what to do next:

Step 1: Download Your Free Bitcoin Starter Checklist

The crypto starter checklist Includes:

Step2: Explore These Next Beginner Guides

To go deeper into your Bitcoin journey, read:

- How to Buy Crypto in 2025

- Best Wallets for Beginners

- How to Avoid Crypto Scams

- Ultimate Beginner’s Guide to Cryptocurrency in 2025

Step 3: Take the First Step

Start small. Buy ₦5,000 or $10 worth of Bitcoin. Set up a wallet. Just get familiar.

Bitcoin is not just digital money, it is a new way to think about money. The sooner you start learning, the sooner you gain confidence.

Table: Bitcoin Starter Toolkit

| Step | Tool | Why It Helps |

| Learn | CryptoPuncher Guides | Avoids newbie mistakes |

| Wallet | Ledger Nano | Keeps BTC safe |

| Buy | Coinbase, Binance, Roqqu | Beginner-friendly |

| Secure | 2FA, Cold Storage | Stops hacks |

| Invest | $10–$50 | Low-risk start |

Source: Cryptopuncher.com

Beginner FAQs About Bitcoin

Here are honest, beginner-friendly answers to the most common questions new users ask about Bitcoin.

-

Can I buy Bitcoin with my debit or credit card?

Yes. Most exchanges like Coinbase, Binance, and Roqqu accept debit and credit cards, depending on the country you are buying from. You can also use bank transfers or peer-to-peer (P2P) payment methods. Just be sure to check the fees, they vary by platform.

-

Is Bitcoin legal in my country?

In most countries, yes. Bitcoin is legal to own and trade in places like the United States, Canada, Nigeria, South Africa, the UK, and many more. However, some countries restrict or ban it. Always check local regulations.

-

What happens if I lose my Bitcoin wallet?

If you lose your wallet and your seed phrase (the 12–24 word backup), your Bitcoin is gone forever. That is why it’s essential to write down your seed phrase and store it somewhere safe offline.

-

Do I have to pay tax on Bitcoin?

In many countries, yes. Bitcoin is treated as property or a digital asset, so when you sell or trade it for profit, it may be taxable.

→ Learn more: Crypto Taxes for Beginners -

Is it too late to start?

It’s not even close. Less than 5% of the world owns Bitcoin. In 2025, adoption is growing, regulation is improving, and beginner tools are better than ever. Starting small and learning as you go is still the smartest move you can make.

Why Trust CryptoPuncher’s Bitcoin Guide?

Unlike hype-driven blogs, CryptoPuncher is grounded in real experience. I’ve traded Bitcoin for 10+ years, earning my Binance certification in 2022.

Our 60+ guides, like this one, are researched with sources like CoinMarketCap and Statista to keep you informed, not misled. Bookmark this, grab our free Scam Defense Checklist below, and join our community on X @cryptopunch_er to stay safe.

If you find this article helpful, then please subscribe to our YouTube Channel for crypto and Web3 video tutorials. You can also follow or join our active communities on Telegram, X (Formerly Twitter ) and Facebook.

Disclaimer

This article is for educational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.