Last updated on April 28th, 2025 at 04:52 pm

If you have heard about how cryptocurrency is the next big thing, either on X or YouTube, and you are still wondering how it works or how to start trading safely without losing your money. You are at the right place to learn it now!

I was once a beginner like you in 2016, skeptical about this whole crypto stuff, but 10 years later, today, I’m here guiding you on the path I have walked. I’m Faith, and at Cryptopuncher, we’re here to make cryptocurrency simple and safe for beginners like you..

2025 is a powerful moment to get started with crypto, and the most confusing time for beginners. There are millions of coins, dozens of apps, and way too many scams.

As of the time of writing this article, there are about 14.15M cryptos, 811 exchanges currently available, and more will be created.

In 2023 alone, FBI released a cryptocurrency fraud report for 2023 containing $5.6 billion in losses to crypto-related scams in the U.S. through its Internet Crime Complaint Center, which was a 45% increase from $3.9 billion in 2022. Investment scams accounted for 71% of these losses ($4 billion).

Therefore, we understand the pain of beginners who are scared of losing money in crypto. Just stick with our guide, and you’ll be happy to have come across this article.

This detailed cryptocurrency for beginners guide on how to start cryptocurrency trading in 2025 will expose you to everything you need to know as a beginner.

I’ll share everything I have learned testing what works without a mentor for the past 10 years of investing in crypto. Be sure to bookmark to read or reference any day, plus, towards the end, I will share a free crypto starter checklist you can download and hold in your hand.

In this beginner’s guide, I will walk you through everything you need to understand cryptocurrency confidently. You will learn:

- What crypto really is, in simple terms.

- Why 2025 is the best time to start

- How to buy your first crypto step-by-step

- How to stay safe and avoid beginner mistakes

This is the guide I wish I had when I started. Count yourself lucky to have this.

Let’s dive in.

1. What Is Cryptocurrency?

It is important that before you buy anything or create a wallet, you need to understand what cryptocurrency actually is.

Cryptocurrency is a type of digital money that is NOT controlled by any government or bank. Instead, it is powered by technology and maintained by people all around the world. You can use it to send money, store value, or even access financial services, all without a traditional bank account.

Think of it like this:

Cryptocurrency is to traditional money what email is to the postal service. Faster, borderless, and not dependent on a middleman.

A. What Makes It Different? Coins vs Tokens

Not all cryptocurrencies are the same. Here is the basic breakdown:

- Coins have their own blockchain (e.g., Bitcoin, Ethereum)

- Tokens are built on top of another blockchain (e.g., USDT, Shiba Inu on Ethereum)

Bitcoin is like the “gold” of crypto, the first and most well-known coin. It is also the most traded cryptocurrency.

Tokens, on the other hand, often represent other things like access to a project, a reward system, or even a game asset.

1. What Is a Blockchain?

A blockchain is a public database that records every crypto transaction in a secure and transparent way. It is like a giant spreadsheet shared across thousands of computers. No one can change it without consensus from everyone else.

Why is this important?

Blockchain is important because it removes the need for banks, governments, or companies to manage your money. That means fewer fees, faster transfers, and more control in your hands.

You may also ask what the connection is between cryptocurrency and the blockchain. People often get confused when blockchain is mentioned. Blockchain is simple a database where all crypto transactions are stored in blocks and they are linked together by a chain. if you send me 1bTc, it will be recorded on the blockchain as soon as the block miners approve your transaction.

So, in simple terms, cryptocurrency uses blockchain to secure its transactions from being altered or manipulated.

In other database system, somewhere can alter what is written there but on the blockchain, you cannot change the transaction details. Blockchain is highly secure database system even government can use to secure their data or electoral system from fraud.

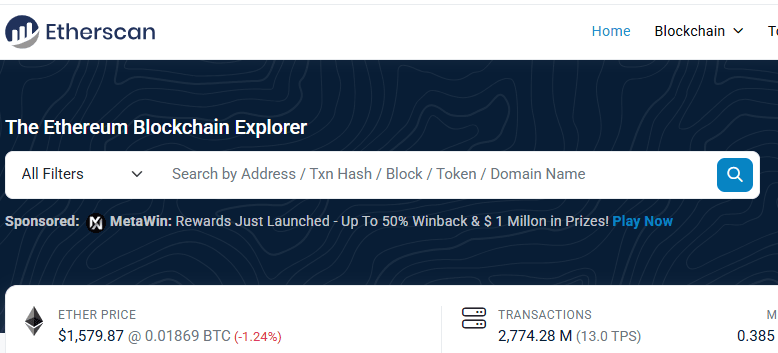

You can access your crypto transactions on a block explorer of the crypto network. As you can see in the image below is the block explorer for the Ethereum network called Etherscan.

2. How Does Cryptocurrency Work?

When you send crypto to someone:

- You use your wallet to create a transaction.

- That transaction is verified by thousands of people on the network.

- Once it’s approved, it is added to the blockchain permanently.

No bank is needed. No office hours. It’s just digital money moving freely anytime, anywhere.

2. Why 2025 Is the Perfect Time to Start with Crypto

If you are wondering whether you are “too late” to get into crypto, the answer is no, in fact, 2025 might be the best time yet. Here’s why I say so:

- Crypto Is Easier Than Ever to Access

A few years ago, you needed a lot of technical know-how to get started. Today, beginner-friendly apps like Coinbase, Binance, Trust Wallet, and Roqqu make it as simple as downloading an app and following prompts.

- You can buy crypto in minutes using your card or bank account.

- Wallets like Trust Wallet let you store coins securely without needing a hardware device.

- Platforms now include helpful dashboards, tutorials, and even customer support.

- Safer Platforms, Better Regulation

Crypto was once the Wild West, no rules, no safety net. But in 2025, things have changed:

- Governments are beginning to introduce crypto regulations (especially in the US, UK, and parts of Africa), which brings more safety for everyday users.

- Top exchanges like Coinbase and Binance are now licensed in many regions.

- Platforms are required to follow KYC (Know Your Customer) rules, helping reduce fraud.

This does not mean crypto is risk-free, but it does mean it is safer than it was in 2017 or even 2020.

- The Rise of Crypto ETFs and Big-Name Adoption

In 2024, several crypto ETFs (Exchange Traded Funds) were approved, allowing people to invest in crypto indirectly through traditional investment accounts.

Big players like BlackRock and Fidelity now offer crypto investment options.

Why does this matter for you?

- It signals mainstream trust in crypto.

- It brings institutional money into the space, which often increases stability.

- It opens up new ways for beginners to explore crypto investing without needing to understand every technical detail.

- Global Adoption Is Growing Fast

Let’s look at some quick statistics:

- Approximately 659 million to 900 million individuals worldwide own cryptocurrency, representing roughly 8.3% to 11.3% of the global population as reported by Crypto.com.

- In 2024, Crypto.com reported 659 million crypto owners (a 13% increase from 583 million in January 2024), with Bitcoin (337 million owners, 51.2%) and Ethereum (142 million owners, 21.7%) leading.

- Statista forecasted 861 million users and 11.02% penetration in 2025; country-specific adoption data.

- Security.org reported that 28% of adult in US own cryptocurrency.

- In countries like Nigeria, Turkey, India, and Brazil, crypto adoption is accelerating due to inflation and unstable local currencies.

- Nigeria and Turkey have the highest adoption rates (47%), with Nigeria (29%) followed by UAE (31%) and Brazil (28%) as reported by Invezz

- Bitcoin ATMs and crypto debit cards are now available in many parts of the world.

- The Federal Reserve (FED) on April 24, 2025, released a press release that announced the withdrawal of guidance for banks related to their crypto-asset and dollar token activities in the US.

- Following sentiment and projections for 2025 on social media by X users precisely, the adoption of crypto is expected to hit (750–900 million owners, 1 billion users.

Is this figure realistic? Well, anything is possible but just know it’s a prediction not a fact.

So, we researched and found the above post made by a user, FloppyAI.

These numbers show one thing: crypto is no longer niche. It is going mainstream, and starting now gives you a head start as the world catches on.

- It Is Still Early (Yes, Really)

Even with all the progress, most people still have not entered crypto. You are still early compared to where things are going.

- In the early 2000s, the internet was just gaining adoption. Now we cannot live without it.

- In 2025, crypto is where the internet was in 2003.

Getting educated and involved now puts you ahead of 80% of the population, safely and confidently, and that is why at Cryptopuncher, we are writing this article to get you onboard earlier enough.

3. Step-by-Step: How to Start with Cryptocurrency in 2025

If you are ready to go from “curious” to “crypto owner,” this step-by-step guide is for you. I will walk you through the exact process most beginners follow in simple, safe, and actionable steps.

Step 1: Choose a Trusted Exchange

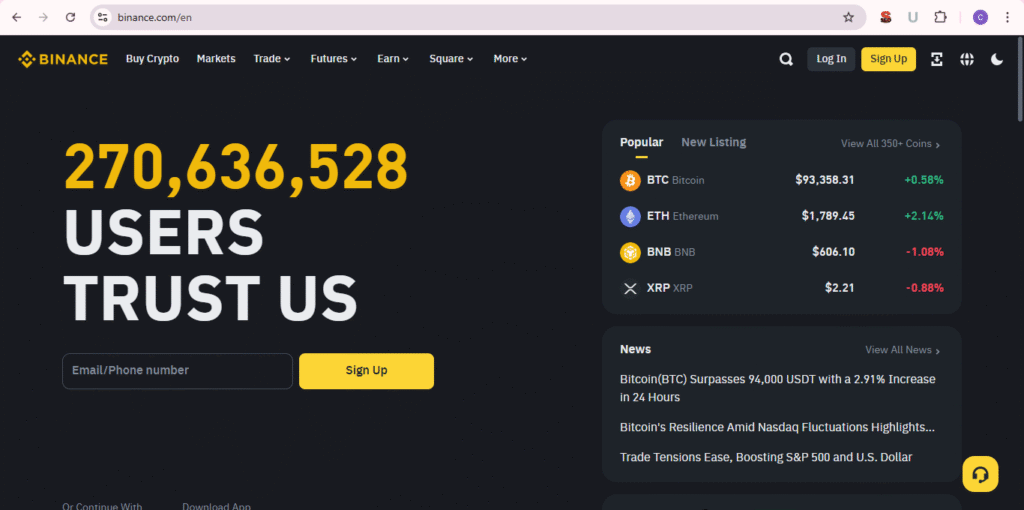

An exchange is where you go to buy your first cryptocurrency. The image below is an example of a crypto exchange called Binance.

Think of it like the “crypto version” of your bank app but instead of dollars or naira, you buy Bitcoin, Ethereum, or other coins.

What Makes a Good Exchange for Beginners?

- It is regulated in your country (e.g., Coinbase is registered in the US, Roqqu in Nigeria)

- It has a beginner-friendly interface and mobile app

- It charges low fees and transparent charges

- It has strong security (2FA, withdrawal protection)

Here are Beginner-Friendly Exchanges I Recommend after Testing Many Exchanges:

| Exchange | Best For | Website |

| Coinbase | Simplicity + US users | coinbase.com |

| Binance | Global users + wide coin access | binance.com |

| Roqqu | Nigerian users (local currency support) | roqqu.com |

Expert Tip: Make sure to use official websites only, scammers create fake versions or click directly from the links we have attached to this post..

Step 2: Create and Verify Your Account (KYC)

To use any legit exchange, you will need to complete KYC (Know Your Customer). This is a legal requirement to prevent fraud.

You will typically provide:

- Your full name and email

- A government-issued ID

- A selfie or face verification

This usually takes less than 10 minutes. Once approved, you are ready to go.

Step 3: Set Up Your Crypto Wallet

A wallet is where you store your crypto after buying it and there are basically 2 main types of crypto wallet which I will list below.

The Two Main Types Are:

| Type | Example | Description |

| Hot Wallets | Trust Wallet, MetaMask | Online/mobile; easy to use but connected to the internet |

| Cold Wallets | Ledger, Trezor | Offline; more secure but costs money and setup time |

If you are just starting out, a hot wallet like Trust Wallet is a good first step. Later, consider a cold wallet if your portfolio grows.

Think of your exchange as a “shopping mall” and your wallet as the “safe” where you keep your coins.

Step 4: Fund Your Exchange Account

To buy crypto, you need to deposit local currency (like USD or NGN) into your exchange.

You can typically use:

- Credit or debit card

- Bank transfer

- P2P (peer-to-peer) if you’re in a region with limited card access.

Note: Always check fees. Some platforms charge 1%–3% for card payments.

Step 5: Buy Your First Cryptocurrency

Start with something well-known and stable, most beginners choose:

- Bitcoin (BTC): The most widely used crypto

- Ethereum (ETH): Supports smart contracts and tokens

- USDT (Tether): A stablecoin that mimics the value of the dollar

Choose how much you want to buy, even $10 is enough to get started.

Then click “Buy” and confirm your order. That’s it, you are officially a crypto investor. Let me celebrate you here for making it.

Step 6: Transfer to Your Wallet (This is Optional, but Recommended)

If you plan to hold your crypto for a while, transfer it from the exchange into your wallet.

This gives you full control not the exchange.

To do this:

- Copy your wallet address (e.g., from Trust Wallet)

- Paste it into the exchange “Withdraw” screen.

- Confirm the transaction and wait a few minutes

Done. Your crypto is now in your control.

Step 7: Stay Informed and Keep Learning

Crypto is fast-moving. Follow these tips to stay ahead:

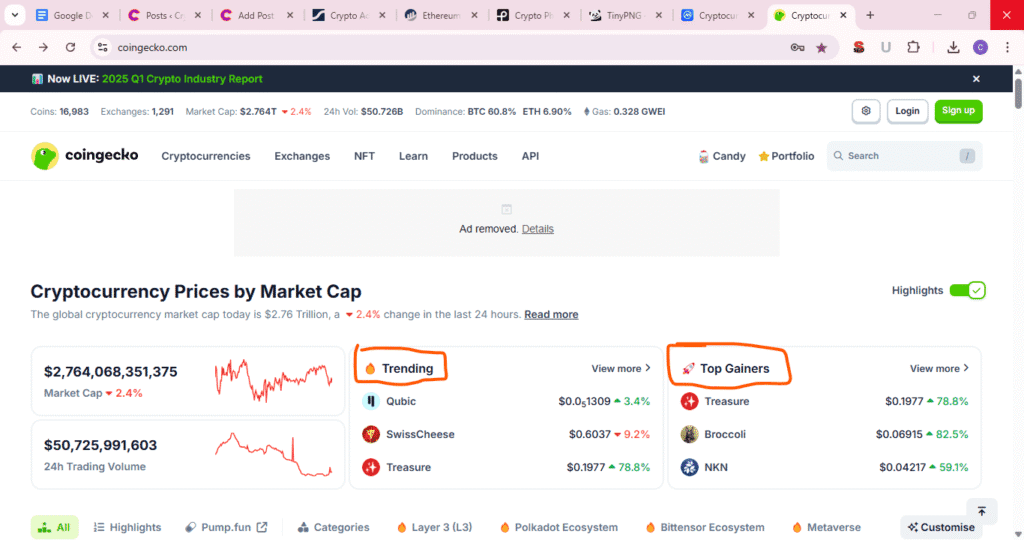

- Use CoinMarketCap or CoinGecko to track prices and trends

- Follow trusted YouTubers or blogs like Cryptopuncher

- Learn about security never share your private key

Start slow, stay curious, and never invest more than you can afford to lose.

How Beginners Can Start Making Money with Crypto in 2025

If you are new to crypto, the idea of making real money from it might feel both exciting and overwhelming. The truth is that you do not need to be a millionaire or a tech genius to start earning.

You just need a clear path, some basic tools, and a smart mindset.

In this section, I will walk you through 7 simple, beginner-friendly ways you can start making money in crypto safely in 2025, even if you are starting from scratch.

1. Buying and Holding (HODLing)

What it is: This is the easiest and most beginner-friendly strategy. It simply means buying a cryptocurrency like Bitcoin or Ethereum and holding it for months or even years, waiting for its value to grow before you sell.

Example: Imagine buying Bitcoin when it was $5,000 and holding it until it reached $100,000. That is the power of patience in crypto.

Action Steps To Take:

- Choose reputable coins (Bitcoin, BNB, Ethereum, Solana, etc.).

- Use a trusted exchange like Coinbase or Binance.

- Store your crypto in a secure wallet (I recommend Ledger for long-term holding).

- Stay patient. Do not panic with every market dip.

Expert Tip: Only invest what you can afford to leave untouched for a long time. Invest money that you are sure you won’t need any time soon. The crypto market is volatile, and your money can dip.

2. Earning Crypto Interest (Passive Income)

What it is: Think of it like putting your money in a savings account, but with much higher potential returns. You deposit your crypto into a platform and earn interest over time.

Popular Platforms To Earn Crypto Interest:

- Crypto.com Earn

- Binance Earn

- Coinbase staking

Action Steps To Take Now:

- Go to Binance, buy BNB.

- Stake coins it with Binance Simple Earn to earn rewards.

- Lend stablecoins (like USDC) and earn interest.

- Research platform safety before depositing funds.

Warning: Stick with well-known, regulated platforms to avoid scams.

3. Crypto Airdrops (Free Tokens)

What it is: Sometimes, new crypto projects give away free coins to early users. You can earn these by simply completing small tasks like signing up, joining communities, or using their apps.

Example: Early users of Uniswap received airdrops worth over $1,000 just for using their platform.

Action Steps To Take:

- Follow crypto news sites like CoinGecko and Airdrops.io.

- Join legitimate crypto communities like CryptoPuncher Community on Telegram.

- Complete simple registration or usage tasks early.

Tip: Always use a separate wallet for airdrops to stay safe.

4. Crypto Trading (With Caution)

What it is: Crypto trading is simply buying low and selling high, sometimes in a single day. While this sounds simple, trading crypto carries high risk and is NOT recommended for total beginners without practice.

I won’t recommend this; rather, you need someone to coach and guide you into trading because you can easily lose money doing this as a beginner.

Safe Way to Start:

- Use a demo account first (like Binance Futures Testnet).

- Start with very small amounts.

- Study simple strategies like Dollar-Cost Averaging (DCA) before trying complex trading.

Important: Trading is risky. Never trade money you cannot afford to lose.

5. Freelancing and Getting Paid in Crypto

What it is: If you have skills like writing, graphic design, programming, or even voiceovers, you can offer your services and get paid in crypto.

Where to Start:

- LaborX (crypto freelance platform)

- Cryptogrind

- Fiverr (Some clients pay in Bitcoin)

Action Steps:

- Create a simple portfolio.

- Sign up for a crypto freelancing platform.

- Specify that you accept payment in Bitcoin, USDT, or Ethereum.

Bonus: You avoid high international bank fees!

If you want to learn how to earn crypto online by offering freelance jobs, check out our detailed guide, 8 Best Online Jobs That Pay in USDT – Earn Crypto Remotely (2025)

6. Play-to-Earn Games (Fun Way!)

What it is: There are some games that reward players with crypto or NFTs that you can sell for real money.

Examples:

- Axie Infinity

- Gods Unchained

- The Sandbox

Action Steps You Need To Take:

- Choose trusted games (avoid shady ones).

- Invest time into learning the gameplay.

- Sell earned assets on marketplaces like OpenSea.

Expert Tip: Be sure to always research the game economy before investing real money.

7. Creating Crypto Content (Blogging, YouTube, TikTok)

What it is: Share your crypto learning journey. Many beginners now earn by blogging, posting videos, or creating TikTok videos about what they are learning in crypto.

Ways to Earn:

- Affiliate commissions (promoting wallets, exchanges).

- YouTube AdSense.

- Sponsorship deals once you build an audience.

Action Steps:

- Start sharing simple crypto tips.

- Stay consistent.

- Monetize with trusted crypto affiliate programs like Coinbase Affiliate.

Reminder: You do not need to be an expert. Documenting your journey can inspire others.

4. Common Mistakes Beginners Make (And How to Avoid Them)

Like seriously, nobody’s perfect, but these traps are easy to avoid if you stick to them:

- Rushing In: Don’t buy during a price spike (FOMO hurts). Wait for a dip or dollar-cost average (buy $20 weekly).

- Ignoring Fees: Small buys on Coinbase can eat 5% in fees. Use low-fee platforms like Kraken or Bybit for bigger trades.

- Falling for Scams: Fake X accounts love posing as Vitalik Buterin. Verify everything.

- Losing Keys: No recovery phrase = no crypto. Write it down, lock it up.

Do you want to spot scams faster? Our crypto scams guide is a lifesaver. You need to keep your crypto assets safe.

5. Safety Tips: How Beginners Can Avoid Crypto Scams and Secure Their Funds

Crypto can be exciting, but it is also filled with traps for beginners. Sadly, millions of dollars are lost every year to scams, fake wallets, and phishing attacks. If you are starting, your #1 priority is protecting your money.

Here is what you need to know to stay safe in 2025.

1. Common Crypto Scams (and How to Spot Them)

- Phishing Websites

Fake websites that look like real ones (e.g., a fake “binance.com”) trick you into entering your password or wallet info.

How to avoid it:

Always double-check URLs. Bookmark the real site. Never click unknown links in Telegram or DMs.

- Giveaway Scams

You see a post saying “Send 0.1 BTC and get 0.5 BTC back”? That is a scam — always.

How to avoid it:

No real company or influencer will ask you to send crypto to “receive more.”

- Fake Wallet Apps

On Google Play or the App Store, scammers upload wallet apps with names like “MetaMask Pro” or “TrustWallet Secure.”

How to avoid it:

Download wallet apps only from official websites — not from ads or pop-ups.

- Pump-and-Dump Coins

Some groups hype up a random coin, make people buy in, and then sell everything when the price rises.

How to avoid it:

Avoid any coin that sounds like the “next Bitcoin” and promises 10x returns in a week.

2. Red Flags to Watch For

- Unverified links in DMs or Telegram

- Promises of guaranteed profit

- Pressure to act “fast” or “right now”

- Projects that have no website, team info, or real utility

If something feels off, stop and double-check. In crypto, it is always better to miss an opportunity than to fall for a scam.

3. How to Secure Your Wallet and Assets

Once you own crypto, protecting it is your responsibility.

- Use a Wallet You Control

Avoid leaving all your crypto on exchanges. Transfer to a hot wallet or, better, a cold wallet.

- Turn on Two-Factor Authentication (2FA)

Enable 2FA on your exchange and wallet accounts. Use Google Authenticator or Authy, not SMS.

- Write Down Your Seed Phrase

When you set up a wallet like Trust Wallet or MetaMask, you will get a 12 or 24-word seed phrase.

Write it down on paper and keep it offline, never save it in your phone, email, or cloud.

- Back It Up (and Keep It Private)

Create multiple paper copies of your seed phrase and store them in secure locations (like a safe or locked drawer).

Never share your seed phrase with anyone — not even customer support. If someone has it, they can steal your funds.

4. How a Beginner Got Scammed

In 2023, a Nigerian crypto newbie tried to buy Bitcoin through a Telegram group offering “discounted rates.” He sent ₦100,000 worth of funds and never heard back from the supposed buyer. This can be so frustrating.

Bitter Lesson:

Never buy crypto outside a trusted exchange. If it is not regulated or official, it is not worth the risk.

5. The Tools and Habits You Need To Stay Safe

- Use a hardware wallet (e.g., Ledger) for long-term holdings

- Verify Twitter/X handles before following project updates

- Use Google Authenticator

- Install browser extensions like MetaMask with phishing protection

- Bookmark official exchange and wallet websites

- Double-check any smart contract before clicking “Connect Wallet.”

6. Key Crypto Terms for Beginners (A Simple Crypto Glossary)

The crypto world is filled with terms that can sound intimidating at first. But once you understand what they mean, everything gets easier.

Here are the most essential terms every beginner should know in 2025, explained in a way that makes sense.

| Term | Simple Definition | Why It Matters |

| Cryptocurrency | Digital money you can send, receive, or store without a bank. | The entire topic of this guide — this is what you are buying. |

| Blockchain | A secure online record of every transaction that cannot be changed. | It’s how crypto works behind the scenes — no middlemen needed. |

| Bitcoin (BTC) | The first and most well-known cryptocurrency. | Many beginners start with Bitcoin because it is the most trusted. |

| Ethereum (ETH) | A popular coin that also lets developers build apps (like DeFi or NFTs). | It’s the second-largest crypto and powers many tokens. |

| Altcoin | Any coin that is not Bitcoin. (Examples: Solana, Cardano) | Understanding this helps you explore options beyond BTC. |

| Token | A type of crypto built on another blockchain (like ETH). | You will see lots of these from stablecoins to gaming tokens. |

| Wallet | A digital tool to store, send, or receive cryptocurrency. | You need this to keep your coins safe, especially offline. |

| Private Key | A secret password that unlocks your wallet. | Whoever has this can take your crypto. Never share it. |

| Seed Phrase | A list of 12–24 words that lets you recover your wallet. | Losing this means you lose access — write it down and store it securely. |

| Exchange | A platform where you buy or sell crypto (like Binance or Roqqu). | You need an exchange to convert your money into crypto. |

| KYC | “Know Your Customer” – an identity verification step. | Required by most exchanges for you to buy safely. |

| Stablecoin | A crypto tied to the value of a stable asset like USD (e.g., USDT). | Useful for avoiding price swings while staying in crypto. |

| Gas Fees | Small fees paid to process transactions on certain blockchains. | You’ll see these when sending ETH or using apps like MetaMask. |

If you want to learn the A-Z of cryptocurrency terminology, check out our 180+ Crypto Glossary Terms Every Beginner Should Know and download our crypto glossary cheat sheet PDF.

Tips for Using This Glossary

- Bookmark this section or download it as a cheat sheet.

- Come back to it anytime you see a confusing term.

- Remember: it is okay to not know everything right away; that is why this guide exists.

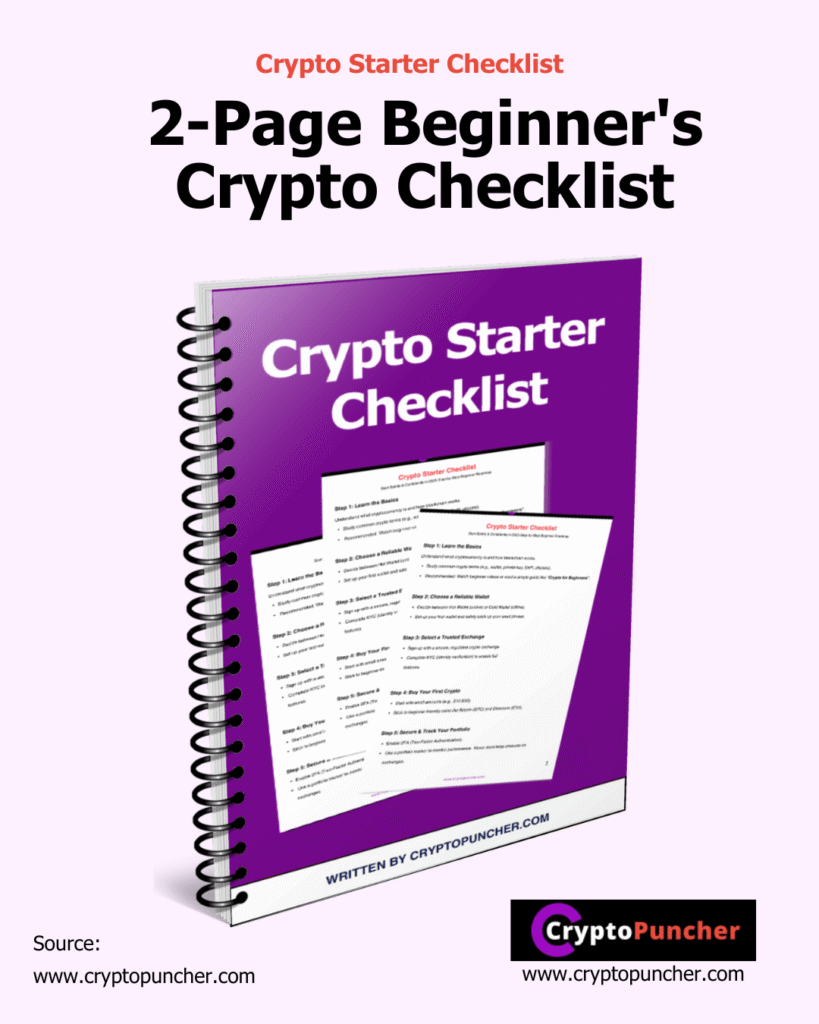

Download Our Free Beginner’s Crypto Checklist

Do you want a printable 2-page summary of everything you just learned?

👉 Get Your Free Crypto Starter Checklist below.

SOURCE: CRYPTOPUNCHER.COM

Download Our Free Crypto Starter Checklist For beginners.

The checklist includes:

- A 5-step beginner roadmap

- Wallet and exchange comparison

- Red flags to avoid

- Daily safety habits

Expert Tip: Use it as your go-to reference every time you log into your crypto app.

To Keep Learning, Explore These 10 Beginner-Friendly Guides

Here are 10 hand-picked guides that go deeper into each part of your crypto journey:

| Topics | Suggested Article Title |

| 1. Bitcoin Basics | What Is Bitcoin? A Beginner’s Guide to the First Cryptocurrency |

| 2. Altcoins Explained | What Are Altcoins? Top Beginner-Friendly Cryptocurrencies to Know |

| 3. Wallets | Best Crypto Wallets for Beginners: Hot vs. Cold Explained |

| 4. Buying Crypto | How to Buy Cryptocurrency in 2025: A Beginner’s Step-by-Step Guide |

| 5. Using Exchanges | Crypto Exchanges for Beginners: How to Pick and Use One |

| 6. Trading 101 | Crypto Trading 101: A Beginner’s Guide to Getting Started |

| 7. Researching Coins | How Beginners Can Research Crypto Projects Before Investing |

| 8. Avoiding Scams | Crypto Scams 101: How Beginners Can Stay Safe in 2025 |

| 9. Security Tips | How to Secure Your Crypto: Beginner’s Guide to Staying Safe |

| 10. Crypto Taxes | Crypto Taxes Made Simple: What Beginners Need to Know in 2025 |

Bookmark this page, explore the links above, and take your time. Each article is written in the same beginner-friendly style — with examples, tools, and steps you can follow right away.

Frequently Asked Questions (FAQ)

Beginners ask some of the same important questions again and again. Let’s clear up those doubts right here..

Is cryptocurrency safe for beginners?

Yes, if you follow the right steps. Use a trusted exchange, secure your wallet, and never share your private key or seed phrase. Crypto is risky if you rush in without knowledge, but it is safe when you start slow and stay informed.

How much should I invest in crypto as a beginner?

You are expected to only invest what you can afford to lose, Many beginners start with $10 or $20 to test things out. Crypto is very volatile, so avoid putting in money meant for rent or emergencies.

Do I need a wallet to start?

Most exchanges give you a built-in wallet, but it is safer to move your coins to a private wallet that you control. For small amounts, a hot wallet like Trust Wallet is fine. As your holdings grow, consider a cold wallet like Ledger

Can I buy crypto with my debit card or bank transfer?

Yes, many platforms support debit/credit cards and local bank deposits. Some exchanges even allow mobile money or P2P transfers, especially in regions like Africa and Southeast Asia. Always check fees before choosing a method.

What is the best cryptocurrency for beginners to buy first?

Most people start with:

Bitcoin (BTC) — trusted, stable, and widely accepted

Ethereum (ETH) is more flexible and used in apps

USDT (Tether) — a stablecoin that avoids price swings

Stick with well-known coins when starting, and avoid random altcoins promising huge returns.

Can I lose my money in crypto?

Yes, if you fall for scams, forget your seed phrase, or invest in unreliable projects. But if you educate yourself and follow basic safety rules, you can avoid most beginner mistakes.

Is crypto legal in my country?

Regulations vary. In many countries, crypto is legal to own and trade (like the U.S., UK, Canada, Nigeria, etc.). However, some countries restrict it. Always check local laws or guidance from your government’s financial authority.

Do You Have Questions?

Drop them in the comment section, we’re here to help.

Do You want Personal help? Join our crypto community on Telegram and Facebook. Watch our tutorial on Youtube Crypto for Beginners.

If you find this article helpful, then please subscribe to our YouTube Channel for crypto and Web3 video tutorials. You can also follow or join our active communities on Telegram, X (Formerly Twitter ) and Facebook.

Disclaimer

This content is for informational purposes only and does not constitute financial, legal, or tax advice. Always consult a certified professional before making financial decisions.

![Read more about the article 7 Best Ways To Generate Passive Income With Crypto [2025]](https://cryptopuncher.com/wp-content/uploads/2024/05/Farming-Airdrops-On-Solana-300x158.png)